Top Disability Categories for SDA Housing: Key Insights for Avoiding Low Occupancy Rates

Here, we break down the top disability categories for SDA housing and provide key insights to help investors avoid low occupancy rates and optimise their investments.

Specialist Disability Accommodation (SDA) investments are becoming increasingly crucial to the Australian real estate market. This is because it is a type of property investment that is driven by funding from the National Disability Insurance Scheme (NDIS). However, many SDA investors face the challenge of low occupancy rates, particularly when their properties are not well-suited to the needs of the participants.

We'll explore the primary disability categories for SDA housing, emphasising the significance of addressing these needs and providing valuable insights to prevent low occupancy rates and improve the SDA housing supply.

Understanding the Key Disability Categories in SDA Housing

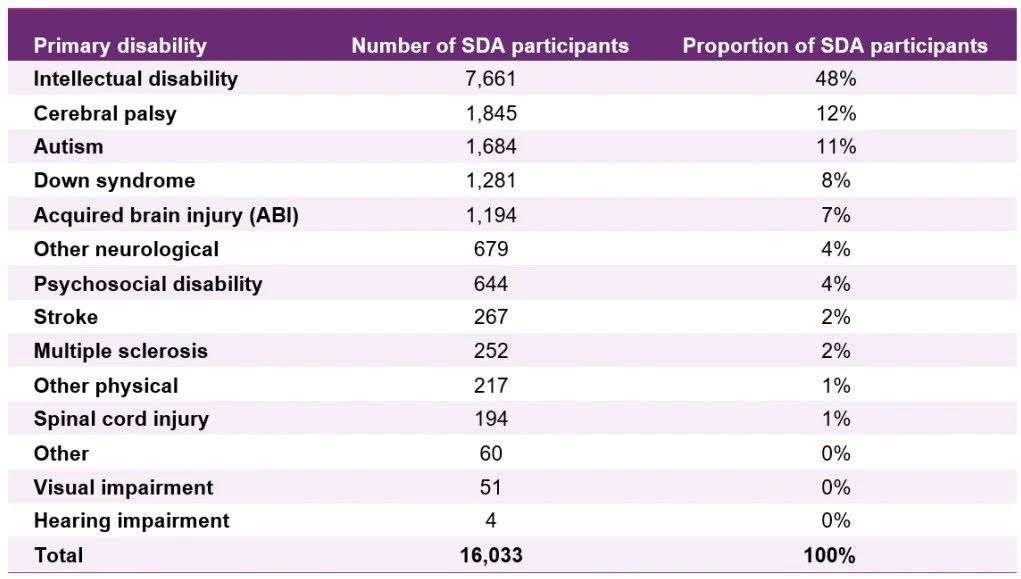

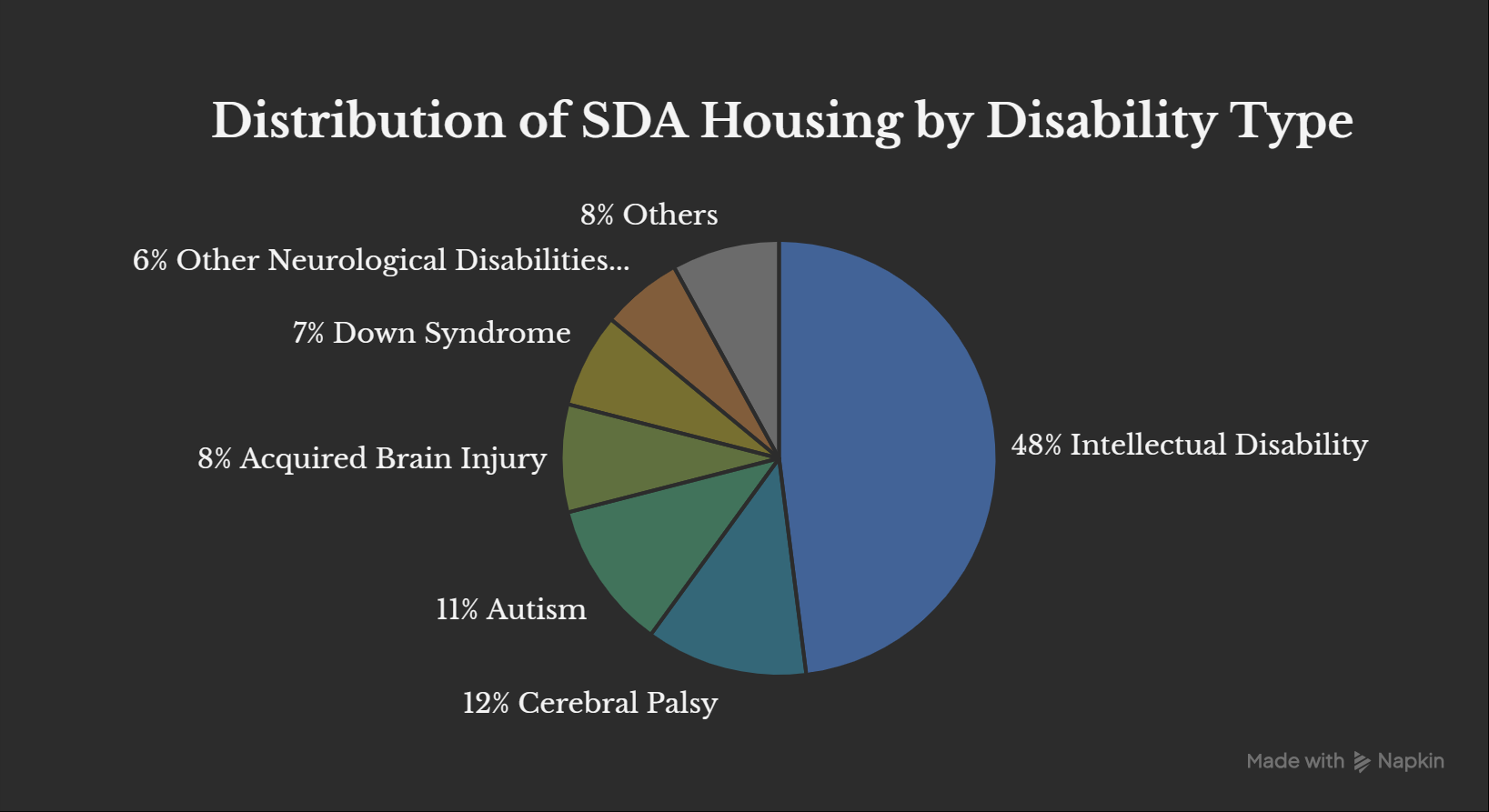

Data released by the NDIS in 2021 on SDA participant disabilities highlights that a data-driven approach is essential for success. While the statistics are a few years old, the total number of SDA-funded participants has remained relatively stagnant, making these insights more relevant than ever.

SDA housing caters to people with varying disabilities, each requiring specific accommodation features. By aligning your investment strategy with the needs of these participants, you can increase your property's chances of being tenanted and generate a steady income stream. Here are the 7 top disability categories that drive demand for SDA housing.

1. Intellectual Disability (48% of SDA Participants)

Intellectual disability is the largest category of SDA participants, making up almost half of all SDA-funded individuals. This category encompasses a wide range of disabilities, including low IQ, behavioural issues, and conditions like schizophrenia. It’s a broad and growing category, and as the number of individuals diagnosed with intellectual disabilities increases, so does the need for housing.

Housing Needs: Intellectual disability participants often require properties that are either Improved Livability (IL) or Robust design to suit their needs. However, Robust-design homes are still in short supply, and there is a growing gap in the availability of these types of properties in the right locations.

Investment Insight: For SDA investors, this category presents a significant opportunity. Focusing on the development of IL and robust homes in areas with high demand can help fill the occupancy gap. Additionally, building in central areas with good access to healthcare, public transport, and support services is crucial for attracting tenants.

2. Cerebral Palsy (12% of SDA Participants)

Cerebral palsy is a condition that affects physical movement and motor skills, and is one of the largest categories of SDA participants after intellectual disability. These individuals typically need high physical support (HPS) or fully accessible (FA) homes to meet their specific mobility and physical requirements, such as this SDA housing in Merrylands, Sydney.

Housing Needs: The demand for HPS and FA homes is growing rapidly, especially for those with cerebral palsy who require accessible features like wide doorways, ramps, and appropriate bathroom and kitchen facilities.

Investment Insight: HPS properties close to disability services and transport hubs are in high demand. While the availability of HPS homes is high, the growing demand for accessible homes in the right locations presents an opportunity for investors.

3. Autism (11% of SDA Participants)

Autism is another significant category within SDA housing, comprising approximately 11% of all participants. Many participants with autism require homes that are either improved livability (IL) SDA housing or robust design. With half of the participants diagnosed with autism being children, this category is expected to grow significantly in the coming years. Early diagnosis and the increasing recognition of autism as a condition mean more participants will eventually transition into SDA funding as adults.

Housing Needs: For younger participants with autism, the demand for IL and robust homes is growing, as these participants will eventually transition into adult services. Properly designed homes with quiet spaces, minimal sensory distractions, and flexible layouts are key considerations.

Investment Insight: Autism is a category with increasing demand, especially as early diagnosis is becoming more prevalent. Investors should focus on future-proofing their properties by designing homes that cater to young adults. The market for these homes will continue to grow as more children with autism age into the NDIS system.

Also read:

Future of SDA: 2027 Demand Data You Need to Know

4. Acquired Brain Injury (ABI) (8% of SDA Participants)

Acquired Brain Injury (ABI) results from an external force or trauma to the brain, such as a vehicle accident or sports injury. It accounts for 8% of all SDA participants and requires HPS or robust homes to meet their specific needs.

Housing Needs: ABI participants often need a safe environment with specialist features to assist in their rehabilitation, including support for mobility, communication, and daily activities. HPS or robust homes are typically required.

Investment Insight: With ABI’s high prevalence in accidents and trauma, the demand for housing tailored to these needs is steadily increasing. There is also an ongoing need to ensure that these homes are available in both urban and regional areas to meet the diverse needs of participants.

5. Down Syndrome (7% of SDA Participants)

Down syndrome is a genetic condition that often requires IL or robust SDA housing. It is one of the smaller disability categories, accounting for around 7% of all participants, but it is still a significant portion of the NDIS housing market.

Housing Needs: Participants with Down syndrome need homes that accommodate their intellectual and physical needs. Many of these homes need to be adaptable, with accessible features (such as bathrooms and kitchens) and supportive environments.

Investment Insight: As demand for Down syndrome-specific housing continues to grow, investing in properties designed with accessibility and flexibility in mind will help fill the gap. Down syndrome participants require supportive environments, so investing in well-located homes that offer a sense of community is key to increasing tenant retention.

6. Stroke (2% of SDA Participants)

Stroke survivors make up 2% of SDA participants. These individuals typically require fully accessible or high physical support (HPS) homes. With physical disabilities resulting from a stroke, participants need specialised facilities to support their recovery and daily living.

Housing Needs: These conditions often require specialised accommodation, which may include homes with fully accessible features and support for mobility and health needs. They would also need specialist features to assist their daily activities.

Investment Insight: As the demand for accessible housing grows, this is a category that should not be overlooked. Investing in FA and HPS homes with features to support neurological disabilities will increase the likelihood of filling vacancies.

7. Other Neurological Disabilities (4% of SDA Participants)

This category includes a variety of conditions, such as multiple sclerosis (MS), epilepsy, Parkinson’s Disease, Alzheimer’s Disease, Dementia, and many more. This category may require either FA or HPS homes. Although it accounts for a smaller portion of the market, the need for appropriate housing is significant.

Housing Needs: Creating a truly supportive home for someone with a neurological disability requires a focus on cognitive and sensory needs. This means designing intuitive, easy-to-navigate spaces that reduce confusion and incorporating calming environments with controlled lighting and sound to prevent overstimulation.

Investment Insight: The strategic advantage in this niche is not just meeting demand, but creating a superior living experience. Addressing sensory, cognitive, and progressive needs can create a "home of choice". This approach leads to greater resident satisfaction, secures long-term tenancies, and builds a reputation for quality and care.

Also Read: Finding the Right Tenant for Your NDIS SDA Investment: A Guide to Creating Impactful Matches

How to Avoid Low Occupancy Rates in SDA Investments

Given the complexity of the SDA market, especially understanding and actually supplying the needs of each of the disability categories. There are several strategies that investors can use to avoid low occupancy rates:

- Understand the Demand: Be aware of the most prevalent disability categories, such as intellectual disability, autism, and cerebral palsy, and build homes that cater to these needs. Many SDA homes are built with high physical support (HPS) features, but the demand for these homes isn’t necessarily as high as for other categories like IL or robust housing. There is a growing demand for robust and IL homes in areas with strong support networks.

- Focus on Location: Location is critical. Investing in properties in central or well-connected areas where participants have easy access to key services and support (like healthcare, public transport, and support networks) will ensure that homes remain filled.

- Tailor Housing to Specific Needs: Each disability category has different needs. Building homes that are specifically designed for the most common disabilities will ensure that your properties are in demand and aligned with participant needs.

- Work with Experienced Providers: Collaborating with reputable SDA providers who understand the unique requirements of each disability category can increase the chances of finding tenants quickly.

- Monitor Funding Changes: Keep track of changes in NDIS funding and review participant plans to ensure your properties are eligible for maximum funding. Be proactive in bridging any funding gaps.

For expert advice on optimising your SDA investment, contact our disability housing specialist team today. Let us guide you through the SDA market to ensure you build a high-performing, focused, and long-term investment portfolio.

Conclusion

The top disability categories for SDA housing, according to the NDIS, are intellectual disability (48%), cerebral palsy (12%), autism 11%, acquired brain injury (8%), down syndrome (7%), other neurological disabilities (4%), and stroke (2%). By focusing on the top disability categories and understanding their demand, choosing the right location, and working with experienced providers, investors can ensure their properties remain filled and avoid the low occupancy rate trap. The SDA market continues to grow, and with the right approach, investors can position themselves for long-term success.