SDA Pipeline Data: Why More Stock Doesn’t Mean More Opportunity

The March 2025 quarterly data released by the National Disability Insurance Agency (NDIA) shows an increase of 1,157 pre-certified SDA dwellings in the national development pipeline. On paper, this looks like growing investment activity in the Specialist Disability Accommodation (SDA) sector. In context, it reflects a recurring issue: the continued expansion of new supply in areas that cannot absorb it.

While the pipeline numbers often appear in government and provider reporting, they are poorly understood and regularly misused by investors, marketers, and even some consultants. The raw figure means little without understanding what it includes, what it leaves out, and how it compares to current demand and service capability in specific areas.

Read also: NDIS Quarterly Report Q2 2024-25 Overview for Investor

What are NDIA Pipeline Tracks?

The SDA pipeline refers to dwellings that have received pre-certification. This means a certifier has confirmed the design complies with SDA standards, and the intent to enrol the dwelling has been formally submitted to the NDIA. These are not completed builds. Many are still in planning or early construction. Some may never be delivered. Others may already be finished and even tenanted but remain listed due to administrative lag.

The data is cumulative and not updated in real time. The figures published in March 2025 reflect a snapshot taken at the end of that month. Most of the dwellings listed were initiated 4 to 6 months earlier, under different lending conditions and before some of the current market restrictions and slowdowns had taken effect.

Interpreting this as a reflection of today’s confidence or demand is inaccurate. It is more useful as a record of past intentions than as a guide for current investment viability.

Where the Growth Is Happening — and Why It’s a Problem

The recent pipeline increase is not evenly spread. It is concentrated in regions where oversupply warnings have already been issued.

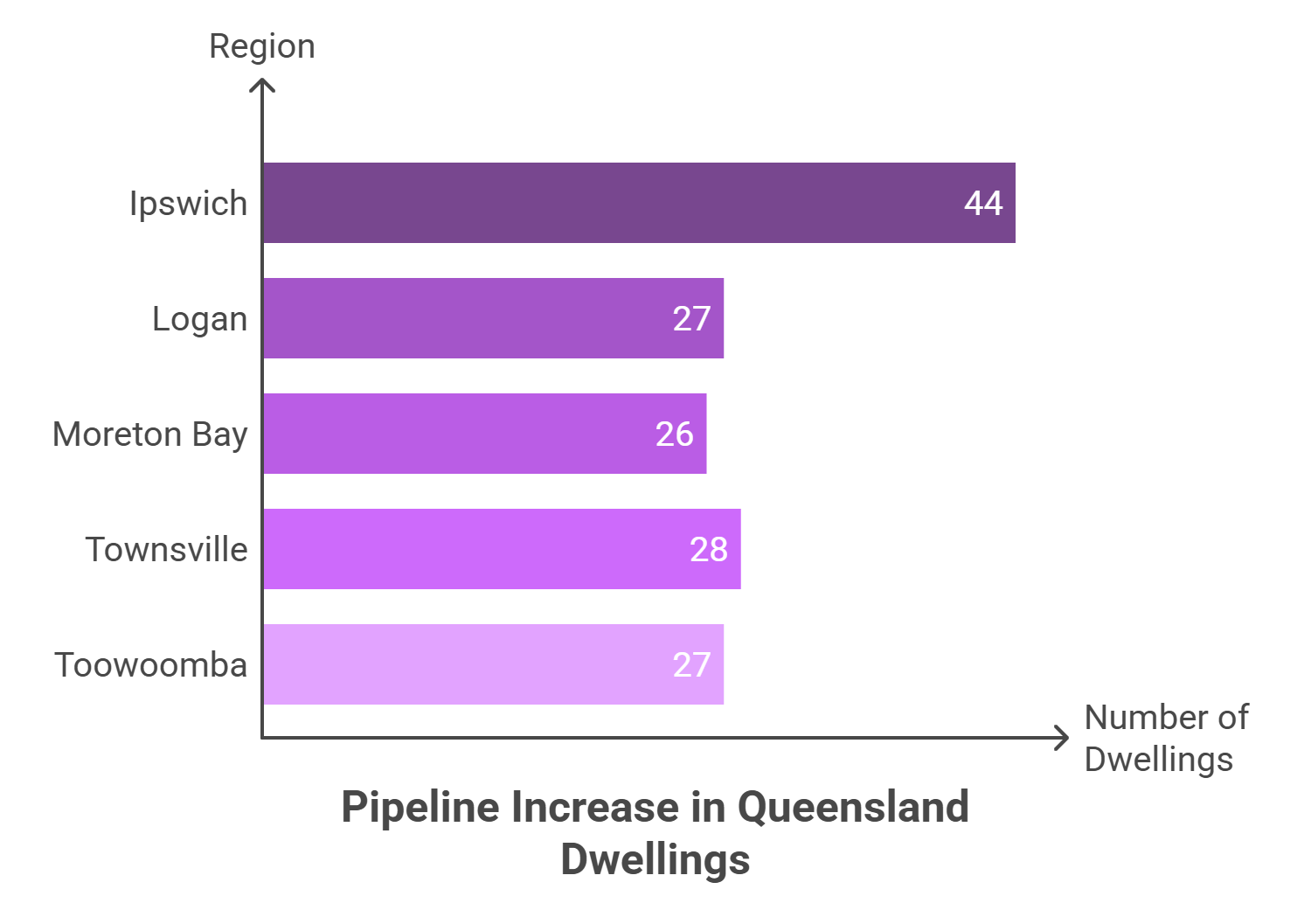

Queensland

Total pipeline increase: +300 dwellings

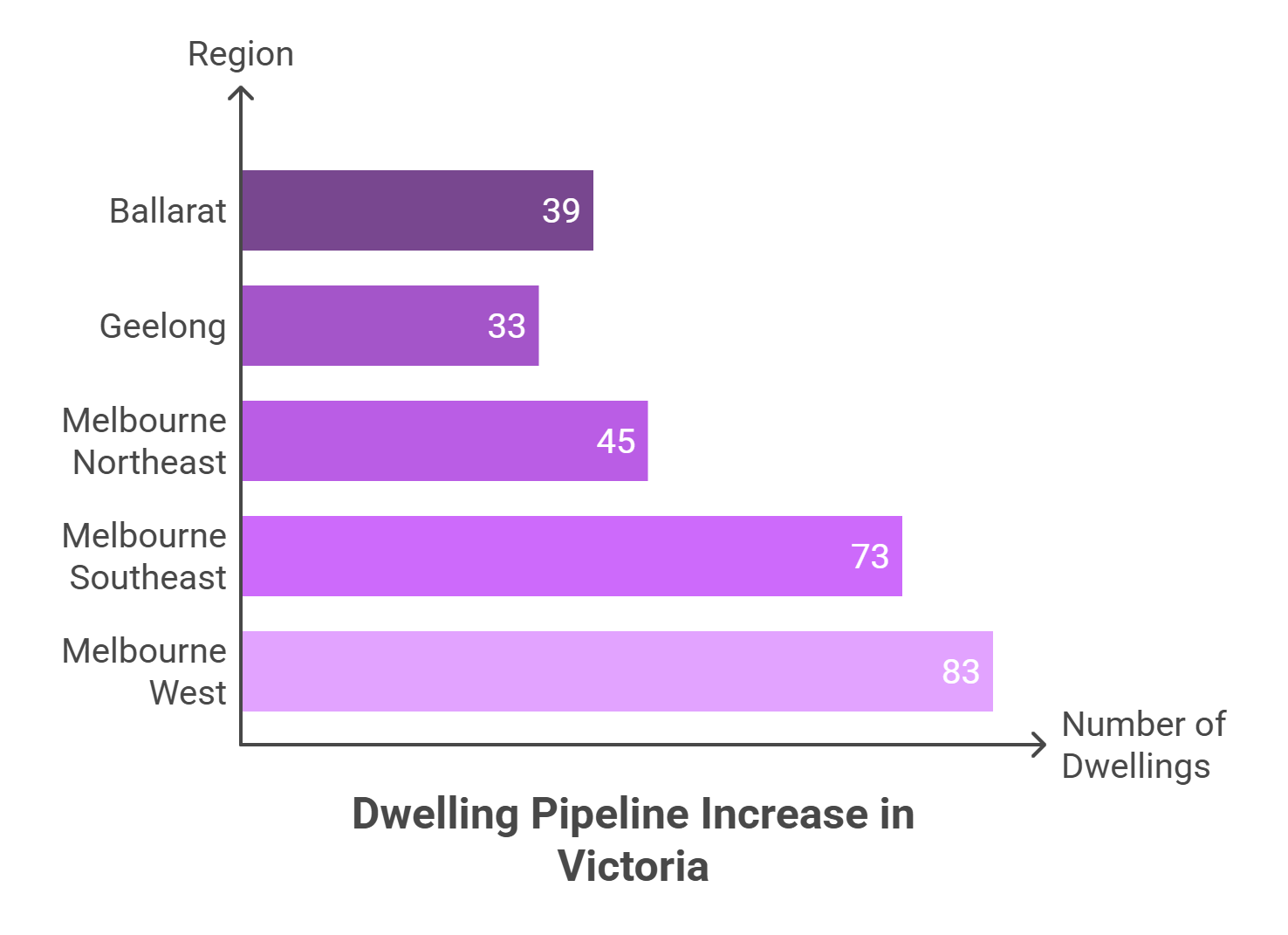

Victoria

Total pipeline increase: +387 dwellings

South Australia

Adelaide North: +56

New South Wales

Total increase: +147

Western Australia (Perth)

- Northwest: +30

- Northeast: +32

- Southeast: +30

These numbers are not minor. In the case of Melbourne’s western suburbs—already considered the most oversupplied market for SDA nationally—an additional 83 dwellings are being pushed into the pipeline. These are regions where providers report tenant shortfalls, service gaps, and long-term vacancies.

There are a few regions showing small decreases:

- Blacktown (NSW): −9

- Riverina (NSW): −1

- Brisbane South (QLD): −3

These minor adjustments are not enough to offset the broader trend of continued overdevelopment.

Read also: Where to Invest SDA Property in Victoria?

The Limits of NDIA Regional Reporting

The NDIA publishes pipeline data by Statistical Area Level 4 (SA4), which groups dozens of suburbs into a single category. This obscures important differences within a region.

Example:

"The Gold Coast added +17 pipeline dwellings in the most recent report. That figure includes high-demand inner suburbs and low-demand outer corridors in one undifferentiated count. The reality is that most new development continues to concentrate in the northern corridor—where vacancies are already an issue—while demand in central and southern areas remains underserved."

In Melbourne Northeast, the same problem appears. The region includes areas such as Preston, Bundoora, Wallan, and Whittlesea. These differ significantly in terms of infrastructure, participant density, and provider coverage. The data doesn’t account for these differences.

Investors relying solely on SA4-level reporting will not see the specific risks tied to local oversupply or infrastructure limitations. Decisions made using this data without additional context are unlikely to match tenant needs or service potential.

Why More Stock Keeps Entering the Pipeline

The growth in supply is being driven by commercial actors—primarily builders, developers, and marketers—who benefit from project volume and transaction throughput. Their role ends once the property is built and sold. They are not exposed to tenant vacancy risk or long-term financial underperformance.

Pre-certification is sometimes delayed or avoided, especially when the builder is replicating an already-certified design across multiple lots. This means the actual number of properties in progress may be higher than reported. The pipeline figure, while already substantial, likely underrepresents the future increase in enrolled stock.

The current regulatory environment does not require builders or developers to prove demand alignment or provider engagement before entering a project into the system. As a result, pipeline growth continues even where it no longer makes sense.

What This Means for Investors

The increase in the pipeline is not a sign of market strength. It is a delayed response to outdated assumptions. Much of the activity reflects decisions made in mid-2024, before interest rates, lender caution, and provider constraints altered the investment landscape.

Investors entering the SDA market now must do more than review pipeline figures.

- Cross-reference with participant funding data

- Confirm provider interest and service coverage

- Investigate local support infrastructure

- Validate location-specific demand, not just regional trends

NDIA data can offer a starting point, but it is not a decision-making tool in isolation.

A Sector That Requires Accuracy, Not Optimism

The SDA market continues to attract investor attention, but the margin for error is shrinking. Poorly located stock, built without tenancy in mind, will underperform. The market does not absorb all supply equally, and recent data shows growth where it is least needed.

Unless investors begin treating this as a data-driven, demand-led housing market, more properties will remain vacant, and more portfolios will underdeliver.

The pipeline increase is a warning, albeit a significant one, that needs to be considered along with other criteria.

For further expert guidance on SDA investment and understanding the pipeline data, click the "Contact Us" button to schedule a consultation with NDIS Property Australia.